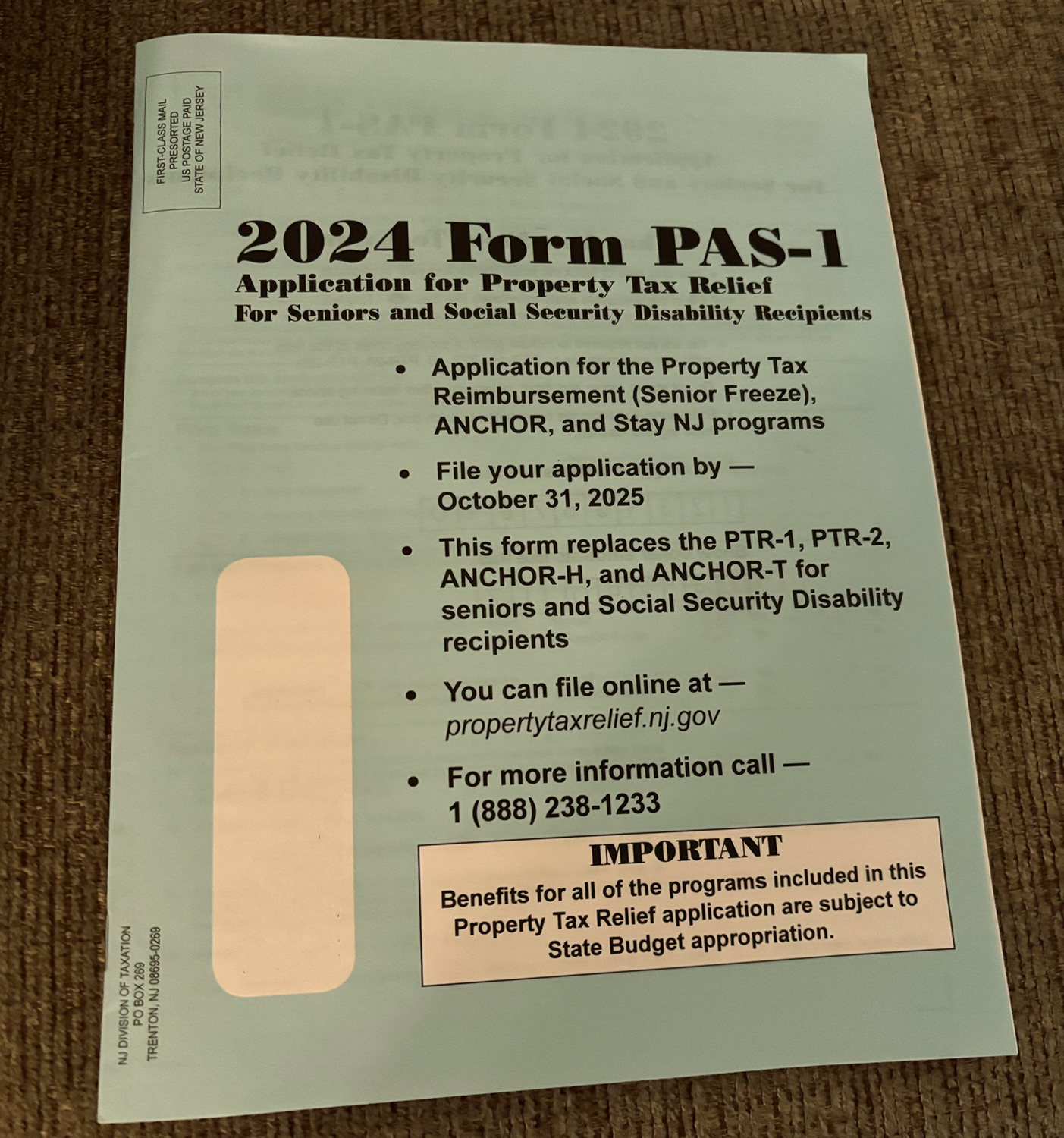

New Jersey has introduced a streamlined property tax relief application for seniors and Social Security Disability recipients. The 2024 Form PAS-1 now allows eligible residents to apply for three major relief programs with a single form: Property Tax Reimbursement (Senior Freeze), ANCHOR, and Stay NJ.

To qualify for the Senior Freeze program, applicants must meet income limits of $163,050 for 2023 and $168,268 for 2024. The application deadline is October 31, 2025, with payments expected later that year. Seniors are encouraged to apply online for faster processing and direct deposit options.

Senator Carmen Amato, Jr., Assemblyman Brian Rumpf, and Assemblyman Gregory Myhre of Ocean County’s 9th Legislative District are actively raising awareness about this new form. The legislative team has been distributing applications at senior communities and is committed to ensuring all eligible property taxpayers can access this relief.

The lawmakers urge seniors and other qualified residents to complete the updated application promptly to maximize their tax relief benefits.

For more information or to apply online, visit NJ.gov. Don’t miss this opportunity to simplify your property tax relief application process and potentially save money through these valuable state programs.